Hello everyone,

It's been about 3 weeks since our last write-up ( That was done on ContextLogic). I have no new information to share on it; however, I will publish an update on it if any of the substrate (developments/news) appear. I do, however, have a minor update regarding supplementary material: the CEO of ContextLogic has graciously agreed to an interview, so keep an eye out. I expect it to be conducted within the next few weeks, and I will publish it once everything is set up.

Now for today's topic at hand. I have recently been studying various European equity markets. As part of that process, I have been going through the old trust "A–Z" method country by country. It has been a lot of fun, and the process has broadened my exposure to the different businesses out there. For instance, I had never considered or studied shell companies that purchase and lease out airplanes to other companies as their only operational activity, or another example was a media company that acquires channel rights and repackages them for resale across borders for profit. A particularly memorable example was an ex-mining company that transformed into a manufacturing chain and later shut it all down for recycling metals for green technologies. The reason it was so memorable was that it reinforced the parallel of business acting like a living creature evolving to survive, and yes, again, making me think about Darwin stocks (you know I have trouble staying away from the topic here and there). As much as I would love to go on and discuss all the unusual, interesting businesses, I think we can get more value if I highlight in a bit more detail just a few businesses in a single country that I found are interesting for further research. From this idea, I'd like to introduce you to the first report, which highlights some interesting companies I discovered while exploring the Polish market. I know Poland has been in the news for its economic growth (or proximity to "friendly neighbours"), but that is not why I'm selecting these companies. I find them interesting and perhaps worthy of further research.

As always, nothing we say or write shall be considered or construed as investment advice. This article is for entertainment purposes only. We may be holding positions in the companies mentioned now or in the future. Please consult a financial professional who knows your situation before making any investment decisions.

Back to Poland. Poland's main exchange is the Warsaw Stock Exchange (WSE), which is owned by the GPW group (of which there is also a significant government ownership with preferred voting rights). Speaking of which, the GPW Group is quite a fantastic Darwin-esque company I recommend taking a look into (WSE: $GPW). They run both the Polish equity exchanges (WSE Main Market, NewConnect, and GlobalConnect), the bond exchange, the derivatives exchange, the commodity exchange with the Polish Power Exchange (TGE), as well as a 65.03% stake in the Armenia Securities Exchange (AMX). I got slightly of track and I'm very tempted to make this whole article about the company as I'm a huge fan, but I'll save it for a different time. While reviewing companies on the WSE, I was impressed by the businesses listed there, both in quality and age. I feel that many are underappreciated. I also observed a blatant pattern: When finding businesses I was intrigued in either by valuation metrics or cash flow generation, a lot of them could be described as a bank (or financial institution), a game development shop (selling video games or like products), or an ex-industrial powerhouse that has evolved into a green recycling or "green" development company. Again, my view can be biased, and it's just the pattern I noticed. Below is a list of two interesting companies that could be interesting to take a look at for further research. I might follow it with a few more in the following weeks as I dive deeper into my shortlists.

Huuuge Inc (WSE: $HUG)

As I alluded earlier, but it really amazed me the number of game shops that were trading on the WSE. For me, the game development space holds a special place in my heart, having briefly worked in it, also starting a short-lived venture in it and seeing a close friend achieve great success here. I also have very fond memories of studying the Activision Blizzard business years ago to learn about the space from an owner's perspective. Anyway, although there are quite a few shops to choose from, I want to highlight Huuge Inc WSE: $HUG.

History

Huuuge Inc.'s story begins in northern Finland, where Anton Gauffin founded the company in 2002. Gamelion is a mobile gaming studio focused on developing games and apps for various handheld devices. Its breakthrough came in 2006 when it partnered with EA Mobile (yes, the "EA Sports to the game" one) to develop 3D FIFA soccer for the Nokia Symbian (for younger audiences, yes, there were games before the smartphone age). In the same year, the company also opened their first branch in Poland. Following the company's success, BLStreams acquired it in the very next year (2007). Over the next few years, the studio produced games for iOS, Android, DS, and other mobile systems, including notable titles such as FIFA, 007 titles, Carmen Sandiego, various "DS Ware" games, and many more. In 2014, Anton Gauffin reacquired the company and rebranded it under the Huuuge name ( Between the sale and reacquisition, he transformed into a venture capitalist and runs a successful family office, where, as he calls it, "partners" with firms, but he also has held board seats and positions at various companies, as well as Gamelion, until 2009). In 2015, the company was reincorporated in Delaware, with a shift in business to focus on free-to-play social casinos and casual mobile titles. (A social casino is a mobile app where you have casino-like games, such as roulette, where you don't bet or play with real money, but tokens earned through gameplay, ads, etc. [granted, there is a theoretical loophole to the definition if you build them around pay-to-play for token games.]). In 2021, the company went public in Warsaw under the ticker $HUG at a valuation of around 1.67 billion Polish złoty ($445 million USD), the largest gaming IPO on the WSE. 2021 also brought changes to the backbone of the business model, which was Apple's new App Tracking Transparency (ATT), affecting the user acquisition and leading to declining revenues in the whole social casino space. The company tried to pivot with the acquisition of "traffic puzzle," with the company sunsetting it in Q1 2023. Notably, Anton Gauffin, through his family account, retains 31.30% ownership of the shares (excluding 6.48% of treasury stock). He transitioned to Executive Chairman in 2023, while Wojciech Wronowski, who joined in 2006, has risen through the ranks to become CEO. This shift also took place as the company changed their strategy to preserve the current client base, use cash effectively and look for acquisitions. One thing that really grabbed my attention, despite declining revenue management, is that they keep calling their company undervalued and putting their money where their mouth is, using a lot of capital for share buybacks, approximately 240M (stupid if they're wrong, but a great capital allocation move if true).

Today

Today, the business is heavily focused on social casinos. With a stated goal of building the most social real-time free-to-play mobile gaming platform, emphasizing player interaction, engagement, and community features in a casino-style environment where users play with virtual tokens rather than real money. Their two biggest game lines are Huuuge Casino and Billionaire Casino, which together account for 90% of the revenue (both platforms have now surpassed $ 2 billion in lifetime revenue). Since the industry shift, the company has pivoted to diversify away from the social casino space and made significant share repurchases. They have implemented cost-cutting efforts such as a 29% workforce reduction (affecting 122 employees) and closed studios (in Finland and the Netherlands), are planning to release pc titles of their successful mobile games, and have released a game pass to better monetize the platform. According to the information I found, executive compensation doesn't seem excessive, and the board's incentives are aligned with those of shareholders, with fixed salaries and a 10x multiplier for performance metrics based on long-term results. Employees do not have equity in the business.

Idea

The business has been plagued by declining revenues, making the advertising-driven model less effective in bringing in players. Therefore, the average number of users playing has dropped significantly, and the business at its core is smaller than it was a few years ago.

Daily active users (thousands): 632 (2017) → 947 (2020) → 610 (2022) → 375 (2024)

However, daily average revenue per daily active users (USD): 30.17 (2017) →35.28 (2020) →43.45(2022) → 49.2 (2024)

As the business has matured, HUG has been more effective at monetizing it while efficiently deploying capital.

Shares outstanding: 80.92 M (2020) → 56.07 M (2024)

Won't bother you with the ratio, but a lot of them look interesting: 3.54 p/cf, ROA 30.85%, ROE 35.77%, Net margin 31.76 (with growth over the last few years), 1.52 PB.

Assets 839.81M → 596.07M Cash + 131.75 Resivables + … + Net PPE 29.33 M + 6.81 Invements

Liabilities 126M → Short-term debt 16.28M + 14.91 Long term debt + …

Net Debt: -564.88 M

The business model itself is extremely capital-light; the operational businesses, although declining, are not dead, and management is aware of the issues. The chairman still owns a significant portion of the company, and they appear to be focused on what matters. They have not shied away from repurchasing shares, and they seem like there could be something there that I plan to explore more deeply.

Stalexport Autostrady S.A. (WSE: $STX)

Quick History

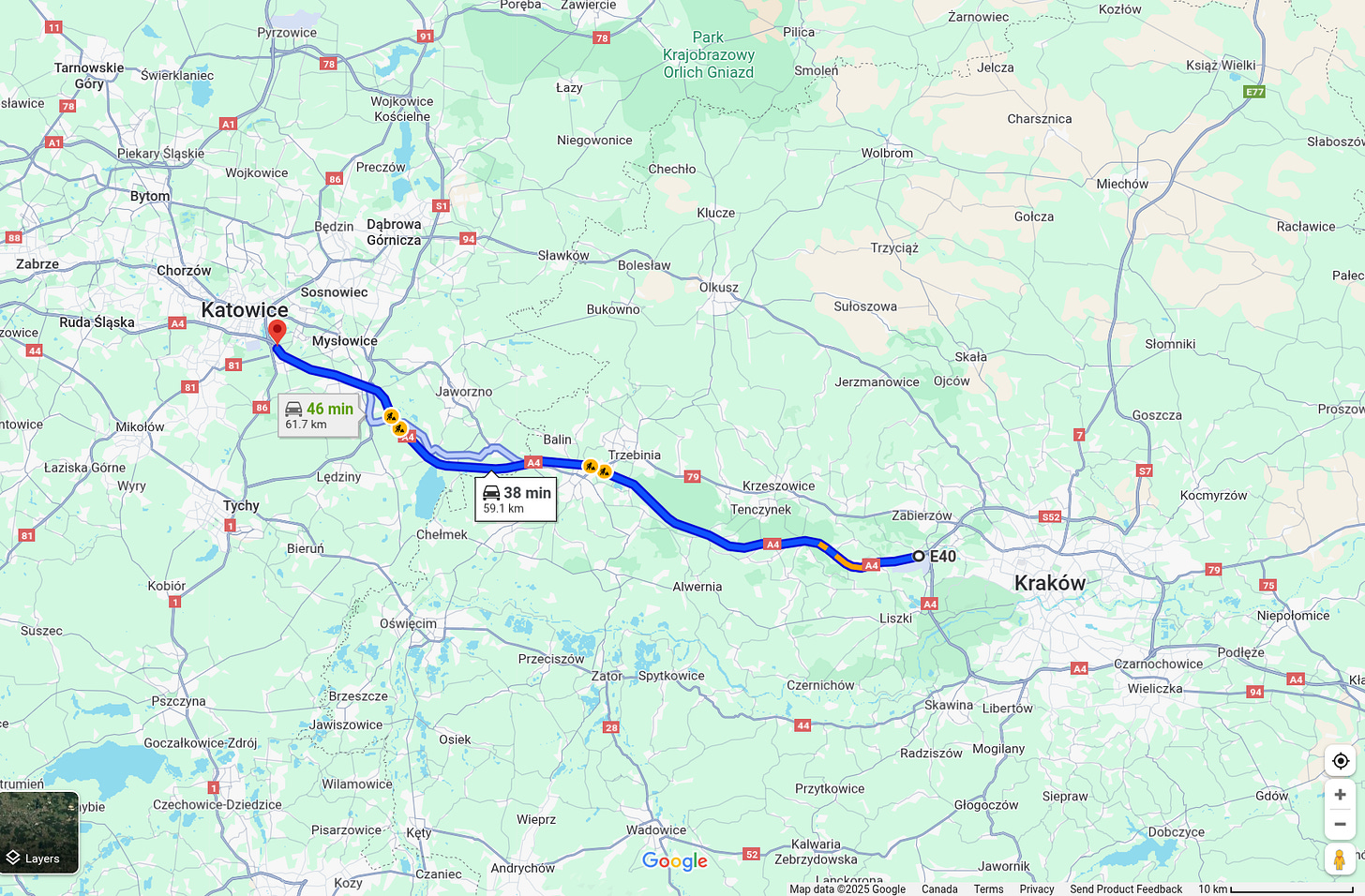

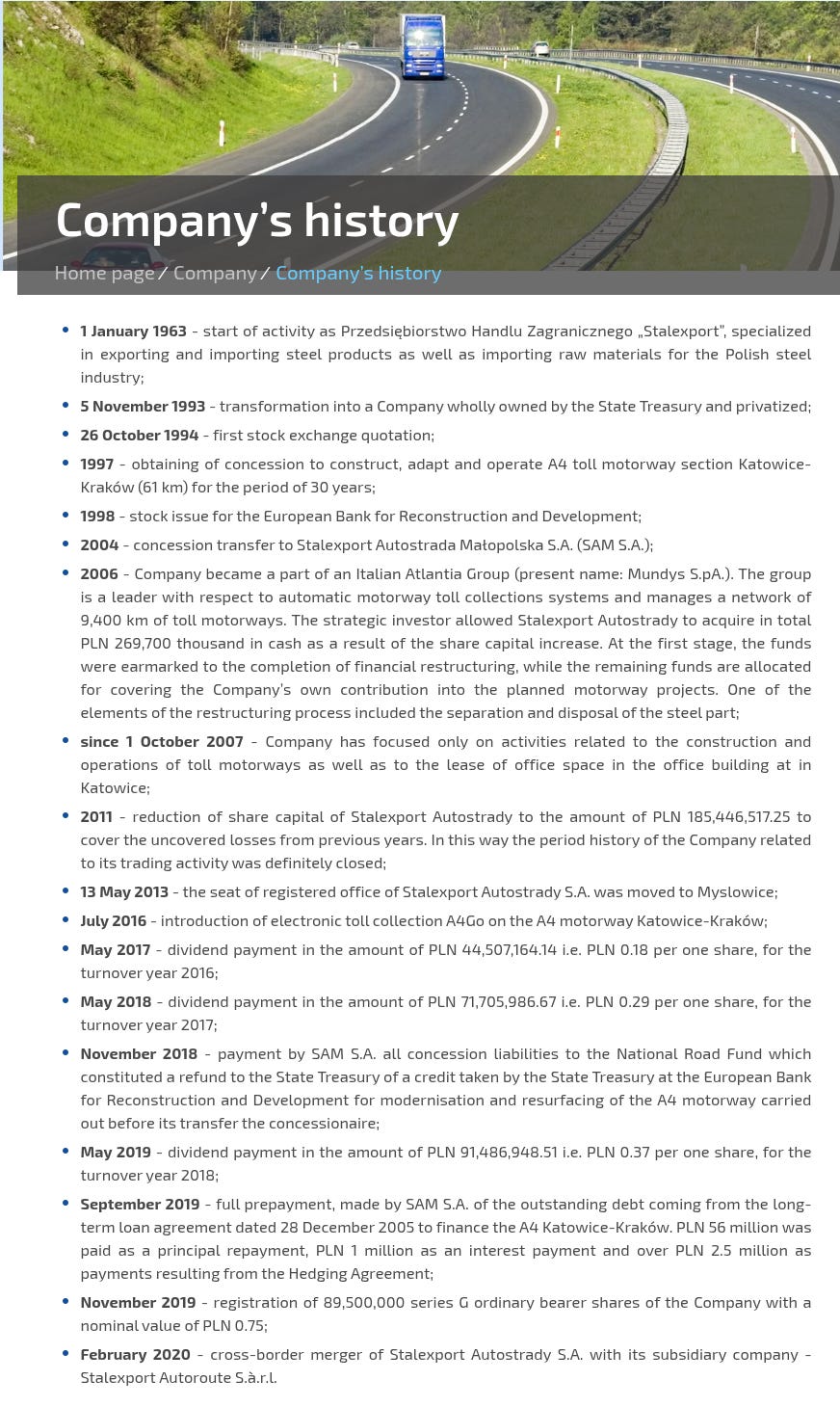

Next up, we took Warren Buffett's advice of finding toll bridges a little too literally and found this gem, Stalexport Autostrady S.A. (WSE: $STX). Founded in 1963 as Przedsiębiorstwo Handlu Zagranicznego “Stalexport”. Originally a steel trading entity specializing in exporting/importing steel products and raw materials, the company evolved (yes, I'm really leaning into the Darwin theme) and transformed into an infrastructure company. Taking advantage of ongoing privatization across Eastern Europe in the 1990s, in 1993, the company was transformed into a company wholly owned by the state treasury and then privatized, paving the way for its listing on the WSE in 1994. In 1997, the company won the winning bid for a 30-year concession (1997-2027) to construct and manage a 61 km toll section of the A4 motorway between Katowice and Kraków (In 2004, the concession was transferred to an entity established solely for this purpose).

Without bothering you too much with the rest of the history, there is an excellent timeline here presented by the company:

Where is it today

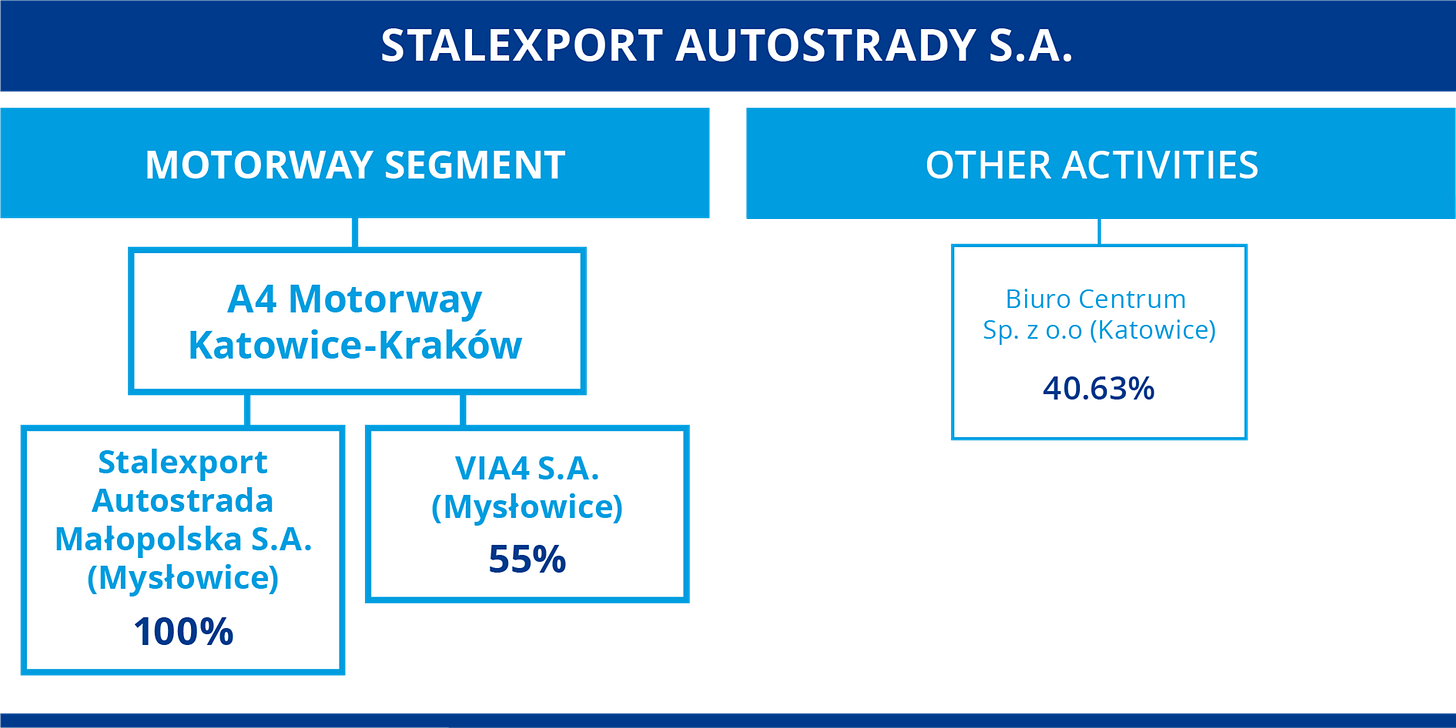

So the company is structured through 4 subsidiaries. The Parent holding company is Stalexport Autostrady S.A. The Stalexport Autostrada Małopolska S.A. (SAM) own the concession and is the operator of the road. Stalexport Transroute Autostrada S.A. (now operating as VIA4 S.A.) is the toll collection support management service and operator assisting the toll system. Biuro Centrum Sp. z o.o. is a property management and leasing service, including office spaces and parking in Katowice. Stalexport Autostrada Dolnośląska S.A., involved in potential motorway projects or expansions, particularly in the Lower Silesia region, will be the primary focus after 2027.

Today, 99% of revenue comes from the toll collection of the 61km road. That means the business is at a pivotal point once its concession expires on March 15, 2027. The company has attempted to expand the project, including adding a third lane and extending the concessions. The General Directorate for National Roads and Motorways (GDDKiA) has firmly rejected extending the concession or favouring Stalexport in a PPP for the A4 expansion, stating it will revert to state control in 2027 and become toll-free for vehicles under 3.5 tons. So the business is in tune for a change soon.

Additional information

Some other things I found in the company is very transparent. Once you learn to navigate through all the possible options on their website, you can find a lot of details. A specific shoutout to their IR department, as it appears they respond to questions with a publicly published follow-up (https://www.stalexport-autostrady.pl/en/company/answers-to-investors-questions). As an investor, the information presented created a better feeling (perhaps a flaw, as it lowered my guard rails, but that's what future research is for).

Idea & Final words

So why could I possibly be interested in a company about to lose its operation? Well, first of all, they still have, well, call it a year and a change of operation on the road. They have historically had an attractive yield from managing the road, and a stable currency seems more likely to yield adequate returns. Plus, the added tailwind of not needing to spend a lot on infrastructure improvement with the concession expiry seems the company will focus on milking the end of the contract.

For the purpose of this quick and dirty analysis, I will refer to the other lines as businesses with a negligible toll road bonus in your purchase. The company currently has a market cap of 726.95M PLN with 5.10 M PLN in debt and 645.57M PLN in cash (so a EV of 86.48M PLN). No dilution in shares and still generating roughly 0.74 PLN of cash flow per share. If we assume a similar earnings year to today (I know traffic has been growing in that section, hence growing earnings over the last few years), we can estimate a call it 130M slot in net income or 100M-120 M in operating cash flow a year. So, if we continued operations with the end of concession payment to shareholders for the 18 months remaining, you could be getting a 2x return on EV from what’s left. I know a lot of level one thinking, but hence this is a teaser idea. However, it appears that you have a significant margin of safety with the cash, and the uncertainty can result in a substantial return.

Thank You

As I mentioned, I've highlighted a few that caught my eye for further research, and I'm sharing them with you in case they bring value. I'll do a few more pieces like this in the future if I see it as a net positive. Hope you enjoyed it and found it interesting.

Cheers

Daniel Andreev -- 18 Degree Partnership, General Partner.