Write Up - Special Situation ContextLogic Holdings ($LOGC)

An Acquisition Play- "Wishing" for More

Hello everyone,

This whole time, I was hinting at a stock write-up; I didn't quite imagine or expect it to be a special situation investment. If you look at my other writing, you would notice I have been hinting and referring to a high-quality compounder, a Darwin/Forever/Coffee-Can investment (especially the emphasis in our annual letter, where I showcased it as a priority investment). Alas, the high-quality assets we are liking are currently far from the price point we are comfortable paying. Still, I promise that if the price is right, you can expect a lengthy email in your inbox. Of course, we are not letting this time go to waste and are finding further evidence to prove (or disprove) our hypothesis, as well as deepening our thesis on the companies in our wish list. Even though I firmly believe that a Darwin stock should be the absolute priority, I do think that when prices are not right, there are some exceptions, especially when looking for opportunities when your fund is small. Buffett had his categories of investments, where he would also explore special situations when he ran his partnership. Munger even used leverage in special situations when he ran his investment partnership in the 60s-70s. So there is some fruit to bear in these ideas.

Before I go on, I should give a quick disclosure: the companies mentioned in the article may or may not be in my holdings. This article should not be construed as investment advice, but for entertainment purposes. Please consult a financial advisor who is familiar with your financial situation. I initially followed this company as an "inverted" case study of a company racking huge cash flow losses with an unsustainable business model, but I stopped paying attention as I waited for it to slowly get swept into bankruptcy. I was reintroduced to the idea when I stumbled upon The Weird Shit Investing manual. The manual is a product of the Weird Shit Investing conference, which is held annually across multiple continents (this year in Hong Kong, London, and New York) where participants pitch their best unusual ideas in a social media-free zone. I strongly suggest reading their manual; it's only 166 pages and has 49 interesting, weird mini-pitches (there is more than one idea that caught my eye, so even exploring to clench your curiosity is worth it). One of these pitches was about the company we are studying and was presented by Chris Waller of Plural Investing LLC (Thank you, credit to him for highlighting the idea).

Now that all the housekeeping and formalities are out of the way, the company we are exploring today is called ContextLogic Inc. (now called ContextLogic Holding as of Aug 7). Based on the name, you may be under the impression that the company is perhaps some sort of advanced AI or a defence contractor or something along those lines. Sorry to disappoint the company, today is simply a shell. I'll explain what that means and what this company is up to in a minute, but first let me give you some background.

Background - A Bit of The Backstory

Although the name ContextLogic Inc. may be unfamiliar, you should have heard of its most successful product: "wish.com!" How did we go from ContextLogic to Wish? I'm getting to that. ContextLogic was founded in 2010 by Peter Szulezewski and Danny Zhang. Peter Szulezewski was the CEO & prominent figurehead of Wish, so let's quietly look at his story.

A Bit About Peter Szulezewski

Peter is a Polish immigrant who first moved to Waterloo, Canada, and spent his teenage and university years there. He attended the University of Waterloo, where he completed a degree in Mathematics and Computer Science (also where he met Danny Zhang) (for those not familiar, Waterloo University is often called the MIT/Stanford of the north, it's a highly reputable computer science school). While completing his education, he had the chance to intern at Google, and upon graduating in 2004, he moved to Palo Alto to work for Google full-time. His main work at Google centred around creating algorithms for keyboard expansion (without using a lot of jargon, essentially it's algorithms that find patterns in searches or terms that help target a likely events, in this case, clicking on an ad). Peter worked at Google for 5 years (2004-2009), and once he built a safety egg, he left to try to create something of his own. He spent 6 months building on his work from Google and in June of 2010 started ContextLogic to capitalize on the opportunity to independently commercialize the same work (raising $1.7 million for this venture).

ContextLogic's Transformation to Wish.com

As Peter saw growing success with his prototype, he invited Danny to join him and build upon their ideas (in 2011). Over the next year, the two entrepreneurs built prototypes to find a central truth around advertising. The main prototype during this time was a private wish list tool that let users bookmark interesting items. Throughout this yearly experience, Peter and Danny gained the core insight that many people didn't buy immediately; instead, they preferred to collect, save, and compare items of interest first. This realization led to the creation of their first popular app, Wishwall.me, a Facebook app similar to their wishlist prototype, a private wishlist where users can share and compare items. As the application gained traction, it actually caught the eye of the platform itself (Facebook). Facebook was impressed by the recommendation engine based on the background algorithm and offered to buy the whole company for $20 million. Peter refused...Otherwise, our story would have ended here. In 2013, ContextLogic was restructured into Wish.com. The lore behind this transformation was Peter's insights into three main aspects. The first was built upon the relationship between consumption habits and the collection and comparison of products from the wish list. The second was the price sensitivity customers displayed, as well as the primary user (especially those who were sensitive) lived away from traditional main markets (think midwestern United States). Lastly, there is a need to develop mobile first. (Some context of the time, during this time, many apps were releasing and were aggressively taking large market share from traditional market players; however, the mobile apps were not always as profitable as the traditional websites before. Think Facebook. During this time, Facebook was in a crisis, rapidly losing users, and its advertising models were struggling in the mobile era. This fact led them to acquire Instagram, a mobile-first social media platform). And so, this is the story of how Wish.com was founded.

Wishful Thinking

Wish.com was restructured as an e-commerce application. Building on the lessons learned from the Facebook app experience, the e-commerce app was developed as a "dopamine-hit app," meaning it was designed for impulse purchases of affordable goods. The vision was to create a so-called "online dollar store." (Essentially, you can call it the pioneer of the temu and Aliexpress that came later, although they relied heavily on game theory and leveraged things they learned in the Chinese market.) Peter and his team planned to accomplish this by connecting directly with manufacturers and utilizing the pay-per-click model, flash sales, and event sales, as well as extensive marketing campaigns.

Wish.com was growing and sending ripples through the commerce space. Not to spread gossip, but from rumours read online, it seems Wish's rise sent panic waves inside Amazon. Amazon had to pivot its business and allow a large, uncensored seller base from China to join Amazon (which ended up giving Amazon a few problems with low-quality goods, counterfeits and seller retention). This rise eventually led to a secret meeting between Bezos and Peter (a fun fact is that Peter idolized Bezos a lot), where Amazon allegedly offered to buy Wish for $10 billion. Peter rejected the offer, trying to pursue his bigger vision. Alibaba ultimately followed this offer with the same $10 billion offer to grow their presence in the United States. Peter, following his vision, continued to build independently and raise money from investors. (He ultimately secured series A through H, with series H helping him raise $ 300-350 million at an $ 11 billion valuation (more fun fact JD.com was one of the investors in this round), before his eventual IPO in 2020). Wish entered a period of unprecedented growth in 2017. It was the most downloaded free app in 2018 worldwide! They made deals to sponsor the Los Angeles Lakers and World Cup stars and were trending across a multitude of social media platforms. In 2019, they became the third-largest e-commerce platform. At the time, Peter's choice not to sell was highly rewarded. As Wish grew, Peter's net worth exceeded $1 billion, and he became the youngest Polish and Canadian billionaire. It seemed, just like his idol, he was at the forefront of becoming an e-commerce icon. Then came Covid.

In March 2020, the world entered the COVID-19 era, marked by months of business shutdowns and a surge in online activity. You would think Wish.com would be a huge beneficiary of this, but quick spoiler: it wasn't. Throughout my telling of Wish's history, I haven't really focused on the business model. The reason is that the company's unsustainable business model made very little sense (in my eyes) and made me very curious if the business could even remain in practice for long. Wish's business model came at a time when the venture business playbook rewarded and incentivized growth above all else (meaning grow now, solve the other issues as you get bigger). This viewpoint implies the company was aggressively spending on what allowed it to grow revenues, and not profits, customer retention, or infrastructure. It's a non-sustainable business model, and COVID ended up being a sort of "poison pill" for Wish. One of the main strategies for growth was aggressively advertised on social media. On social media, the main function of acquiring advertising space is through an auction-driven system. This fact means you are at a disadvantage when there is a growing number of participants. During the pandemic, as other advertising avenues closed down, companies migrated to advertising exclusively on social media, raising the prices to advertise. Wish, which pre-pandemic was the largest advertiser on Instagram and Facebook as well as one of the largest on Google, had sudden surging costs. To add to the trouble, the amazing algorithms that fueled Wish’s growth were optimized to maximize click engagement, implying that a large proportion of clicks lead to users looking at cool products but not buying them. Two bad tailwinds are already bad enough, but at the same time, Wish was dealing with a technological shift. Phone makers started prioritizing user privacy and safety, as well as stopping spamming users for improved experiences on their devices (Apple did this in the iOS 14 update). This transition altered how user data was stored and shared between apps and the operating system, ultimately compromising the data that Wish’s algorithms used to target users. The business of selling cheap goods comes with its own risks. The problem when keeping prices low is that you sacrifice many checks and balances to quality and theft. This vulnerability was fully exposed on Wish’s platform, leading to lawsuits for counterfeits and product liability. Wish was not “super” compliant with the regulation. In France, Wish's biggest market after the US (Italy being third), Wish was found guilty of false advertising, but more importantly, of selling unsafe products (90%+ of electronics and 95% of others found not safe or environmentally non-compliant). This conclusion led to restrictions on advertising and operating, delisting from the Play Store and iOS store and blocking of Google, Bing and Qwant, essentially killing the company there. Speaking of regulations, it’s worth mentioning that one of the enablers of Wish’s low prices was not just direct selling from manufacturers, but also exploiting a loophole in import tax law where small items were tax-exempt. This kept prices lower, and the issue has slowly gained traction as a political topic (especially more recently as Temu gained popularity). The 2011 agreement allowed packages weighing 4.4 pounds or less to be shipped from China to the U.S. for less than the cost of shipping between states. This agreement was revised in 2018, further eroding that business cost advantage (and could be revised again). To give the company some credit if you listen to the quarterly calls and skim annual reports, they were aware of their issues (from 10k 2021: “In 2021, we faced the headwinds of reduced retention and new buyer conversion and a rise in digital advertising costs. In response to rising digital advertising costs, which contributed to lower marketing efficiency, starting in the third quarter of 2021, we decided to significantly reduce our digital advertising expenditures as we focused our resources on other strategic initiatives.”) They attempted to pivot and restructure the company by establishing an infrastructure network and introducing payment guarantees to combat scams. Additionally, they sought to implement quality checks and reduce shipping times, but it was too little, too late. In 2022, Temu entered the American market and began competing with Wish. Instead of saying how bad that was for business, I'll use their own sentiment from Q2 2023: "The competitive landscape is changing rapidly in the cross-border ecommerce space, and we are experiencing unprecedented headwinds from intensified competition in the industry."

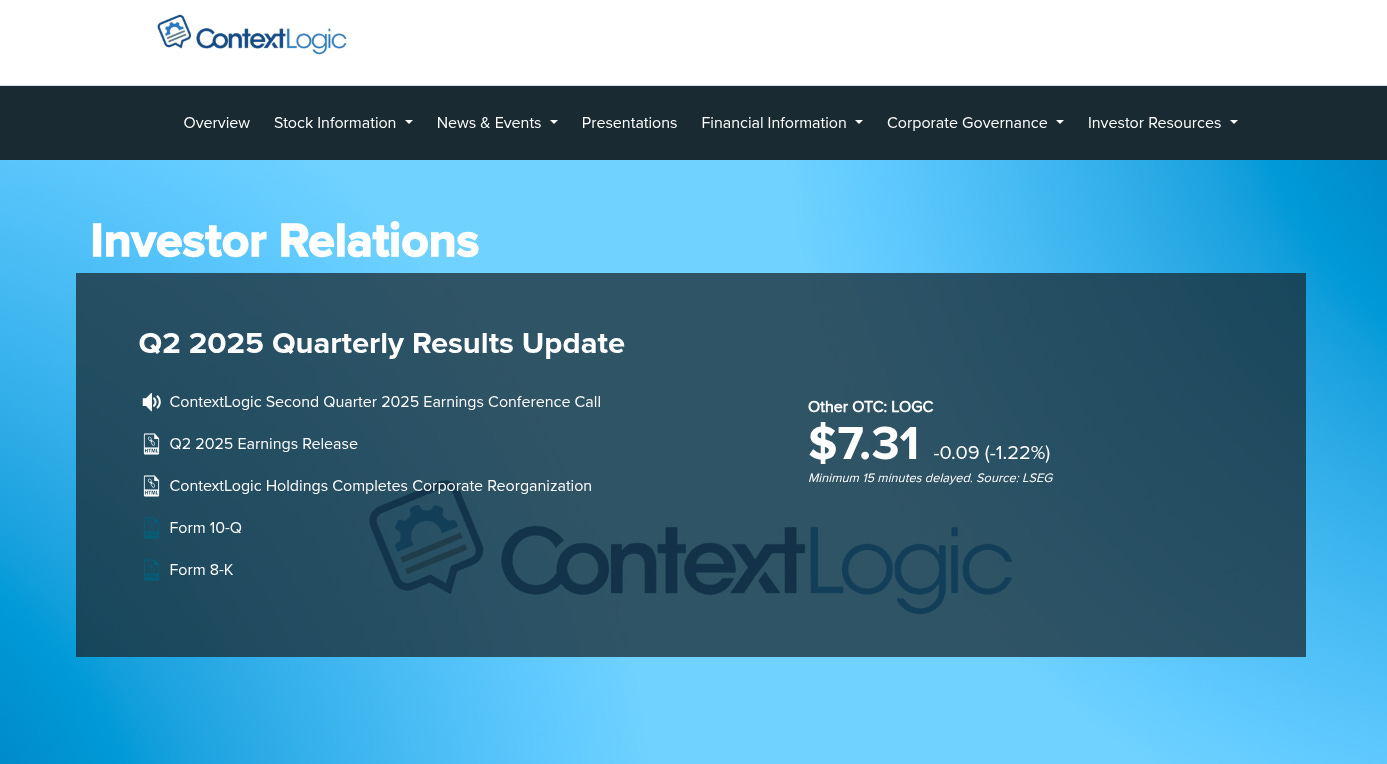

This is the end of the story of Wish.com in February 2024. Wish.com was sold for 173 million, 161 million in closing cash (crazy to think a company that was worth over 22 billion just within the same 3-year period). The company was restructured back to ContextLogic Inc. and delisted from the Nasdaq in June of this year (2025). On August 7, the company underwent restructuring and is now called ContextLogic Holding, trading on the OTC markets. Today Wish is still in operation under the Qoo10, which bought the company in 2024, a Singapore company (initially started as a joint venture with eBay and Giosis group (South Korea)), which also had a similar situation to Wish and entered bankruptcy at the end of 2024.

Back To Reality

The history itself is pretty useless for this investment case, except for identifying any liabilities that could still be inherited due to the Wish.com operations. It should be noted that Wish did get sued multiple times and has settled numerous times in various class action cases (examples included: Choon's Design LLC v. ContextLogic Inc., REACT Lawsuit, "Original Price" Class Action Settlement, Advertising Texts Class Action Settlement). So let's quickly go over the agreement.

In February of 2024, it was announced that an agreement to sell substantially all of ContextLogic's operating assets and liabilities to a e-commerce platform, Qoo10 Pte. Ltd., was reached. The transaction officially completed on April 19, 2024, when ContextLogic received $161 million after all price adjustments. Under the agreement, the assets that ContextLogic kept were net operating Losses (NOLs), marketable securities, and a portion of its cash and cash equivalents. To expand on what liabilities were inherited by Qoo10, you may find under section 2.3-2.4 (https://www.sec.gov/Archives/edgar/data/1822250/000121390024012273/ea193410ex2-1_contextlogic.htm), but to summarize, all liabilities (even some fees like the 6 million dollar coverage of third-party advisor fees) were inherited by Qoo10. The liabilities exempted are any related to "excluded assets" in the agreement, liabilities for excluded employees (any employee not transferring to the new company, meaning any severance or unpaid wages), certain taxes, and excluded third-party claims, (this one is worrying as we can't see what the full potential liabilities are), and the seller's transaction costs.

Based on all public information, it appears that ContextLogic has significantly streamlined its operations and reduced cash burn. I do have some minimal worries about the section "all Third Party Claims set forth in Section 2.4(d) of the Disclosure Schedule (the "Excluded Third Party Claims"), but the risks seem minimal.

The Thesis

Okay, so I have been sharing a lot of information with you. Some of it might be useless for taking advantage of this special situation, but at least it helps us understand why it exists and where it came from. In the introduction, I introduced ContextLogic as a shell. This is because it has effectively ceased all operations, as it currently comprises a package of cash and marketable securities, and the retained NOLs, with nothing else. The thesis is that: the market is undervaluing the value of the assets on the companies' books, and a strict contractual timeline aims to catalyze and unlock this within 16-24 months.

The NOLs

Before I go on (yes, yes again), what are NOLs? Net Operating Losses (NOLs) occur when a company's expenses exceed its revenues in a specific tax period. A company can then save them and carry them forward to reduce income in a profitable year, hence minimizing the taxes paid that year. It's a standard tool used in the past decade with startups, rationalizing losses over the years in a growth story. Here is a simple example:

Let's say in year 1, when you're trying to build your business and grow it, you spend $200k with profits of $100k. A loss of 100k or a NOL of 100K.

In year two, you make a profit of $110k; you can write off the $100k and pay taxes on only $10k.

In year three, you are $121K, and you have no more NOL and would be subject to taxes for the full $121 K.

The other thing to note about NOL is the number of years you may carry them forward. There are currently two types of NOL (in the US): Pre-2018 and Post-2017. For NOLs that originated before January 1, 2018, you may be carried forward for 20 years. For NOLs after December 31, 2017, you may carry them indefinitely, but you are capped at 80% of your taxable income per year (also, the Covid aid package allowed a five-year carry back for NOL between 2018-2020). Since ContextLogic was not public for all years of operation, we don't know the full proportion when each NOL was generated. However, even if we take the conservative assumption that they were all "originated" in 2010, that would mean until 2030, under pre-2018 rules. Another factor for NOLs is that state taxes could vary from state to state. For example, for the taxable period of 2024-2026, California has suspended the application of the NOLs for profits originating in California exceeding $1 million. Another example is Illinois, which has a temporary cap of $500k NOL deduction until 2028.

The reason I'm emphasizing the NOL is that ContextLogic's balance sheet carries $2.7 B in NOLs. The thesis is centred around unlocking the value of the NOLs, and therefore, it's important to understand how they work.

A key fact to know about NOLs is the IRS's Section 382 limitations and the purpose of a Tax Benefits Preservation Plan. The limitation is that when an entity has a significant ownership change (an individual or corporation buying 5% of the company), the company's abilities to use its NOL are limited based on this formula: Annual NOL Limit = (Value of the company's stock before the change) x (a specific IRS-published long-term tax-exempt rate). To protect against this, Contextlogic Inc., the company, has restructured under a holding company, Contextlogic Holding. This structure includes a special clause: when an entity acquires 4.9% of the shares, all other shareholders can buy stock at a significant discount, diluting the entity (authorized to issue an additional 3 billion shares vs the current 26,612,092 outstanding).

Financial Position

All data presented below are as of the release of Q2 2025, with data from June 30, 2025. Taken for the Q2 report :

Cash & Cash equivalent: 27 Mil

Marketable securities (in US government instruments): 192 Mil

Prepaid expense: 2 Mil

Accounts payable: 1 Mil

Accured liabilities: 2 Mil

Redeemable non-controlling interest (BC Partners, will go into detail in a minute): 75 Mil

Shareholder Equity: 142 Mil

Shares Outstanding: 26.6 Mil

Book/share: About $5.3

For the quarter:

$7 Mil General & admin expenses ( of which six mil for employee legal and other professional services (of which three mil is stock comp), 1 Mil for pursuit of business acquisition), 2 Mil earned interest on us debt instruments.

= Loss of 5 Mill.

Very crude calculation of yield on debt (could be wildly off depending on what they own and the maturity/yield relationship when they sell) (4*2)/192 = 4.17% yield. In the 6 months, shareholder equity has dropped by 9 million because of fees on restructuring, compensation, and expenses for the search on the acquisition. Management said on the earnings call on Aug 7, cash and securities are expected to stabilize around 218 million by the end of the year.

BC Partners

As you may have noticed in the info above, there is a mention of BC partners' "loan" to ContextLogic. BC Partners is a private equity, credit, and real estate firm that was founded in 1986 with approximately $46 billion in assets. Their past track record is tricky to find, but I found some partners exited with a 16% IRR in Fund XI. In February 2025, BC Partners invested to unlock the NOLs' values. The deal involved the issues of preferred shares that are convertible at 1:1 to common shares. The dividend rate on the preferred is at 4% pre-acquisition and 8% thereafter. The investment is made at an initial investment of 75 million (hence a 3 million a year dividend) and another optional trench of another 75 million at the same valuation as the first trench if ContextLogic needs it at the time of closing of the acquisition. Currently, 20.8% of ContextLogic Holdings is owned by the BC partner. If the second trench is extended, the ownership would shift to 41.6% for the BC partner and 58.4% for ContextLogic. BC partners also brought their own personnel on the board of ContextLogic to help with the pursuit of the acquisition (notably Ted Goldthorpe and Mark Ward). Bc partner does have an exit clause (a time-conditionally clause, usually after 2 years). This means that if no agreement is reached by the deadline, the BC partner can require ContextLogic to repay them $75 million, along with the dividends. To underscore that BC partners are better positioned to capitalize on this opportunity than the retail investor in this transaction.

Risks

When examining the potential barriers to these special situations, several risks arise. Here are the main risks I am considering: regulatory and lawsuit risks, Cash Burn, BC Partners, Lack of Selling Liquidity, and the possible failure or poor acquisition.

Regulatory & Lawsuit Risks

The whole thesis is built around utilizing the NOLs; if the regulation/tax law on their usage changes, it could significantly affect the value you can bring out of them. I think the risk of this is low, but something to keep in mind. The other risk is any lawsuit. Although most of the risk associated with wish.com is gone, it's not all; some contingent liabilities or residual litigation risks could remain. The likelihood of this risk is also low.

Cash Burn

ContextLogic has made many steps to lean operations and keep costs low. However, the salaries for employees involved in acquisition searches and corporate functions, as well as board fees and associated costs linked to governance and investor oversight, persist. Moreover, any potential transaction-related expenses tied to acquisitions or restructuring.

BC Partners

BC partners and the members they brought in may face misaligned incentives due to their lock-up period and restricted shares. However, it seems like the profit structure has been aligned with shareholders. The new ceo incentives are also aligned with a significant payday if targets are met ( a payday of 12-30 million / a big impact on his net worth). The risk of mismanagement is low.

Lack of Selling Liquidity

The company is quite small, and in case of acquisition or not, there could be very thin liquidity to exit the position, which could lead to selling at a discount to fair value, if not being able to sell at all. The risk is medium of having trouble exiting at fair value (also can't forget the opportunity cost...).

Possible Failure or Poor Acquisition

There is also a risk of not finding an acquisition and the company winding down before any more cash burn (if done today), which would be a loss of approximately $2.2 per share (or about a 30% drawdown). The other is a value-destroying acquisition. It's challenging to vet this thoroughly beforehand, but the management and CEO Rishi Bajaj's track record appear promising. Given that many are working full-time on this, we will assume the risk as a small to medium one.

Showcase Scenarios

As Charlie Munger said, you could massage any projection you want, so we will not spend a lot of time here. Let's consider two scenarios: one where no acquisition is made, and another where one is made with some promise.

If we believe the stabilization of cash at $ 218 million, as mentioned in the August quarterly call, and assume the treasury yield will cover the 4% dividend, along with a conservative annual burn rate of $8 million for exit and liquidation by February 2027. (All very approximate calculations with shortcuts taken)

Shareholders' equity loss of 12 million /#shares:

(142 - 12)/26.6 = $4.89/share

Today's price is $7.31/Share, so a loss of $2.42/Share or 33%.

For fun, let's just do a simple DCF. Let's say ContextLogic buys a 25-million-profit/year company at 8x earnings ($200M). The $ 25 million is equivalent to $ 31.65 million before taxes, or $ 6.65 million a year saved in taxes. If we assume a 1% growth in earnings and a 10% discount rate, the same applies to the NOL.

PVCF=25M×(1−(1.01/1.1)^3)/(0.1-0.01) = 63M

FCFY3=25M×(1.01)^3=25.757525M = 25.8M

TV = (FCFY3 * (1 + 0.3) )/ (0.1-0.03) = 380 M

PVTV = 380M /1.1^3 = 285

PVNOL = 6.65M * (1−(1.01/1.1)^3)/(0.1-0.01) = 17 M

EV = PVCF+ PVNOL + PVTV = 63 + 17 +285 = 365M

EV / Share = 13.72 per Share or 88% over the three years.

Again, everything is rounded, so you can change the number as much as you want. You can use different modelling techniques to get any number. The moral is that the 2.7B in NOL unlocks a huge profit for shareholders.

Additional Info

I found a few different things through the research, but if we trim it, these are the only things really worth noting:

A similar play was done successfully between KKR and WMI Holdings (WMIH, a spin-off of Washington Mutual). KKR took control and turned WMIH into an acquisition vehicle to capitalize on WMIH's estimated $6 billion in NOL carryforwards.

There were also cases where a similar structures failed to capitalize on NOL due to IRS Section 382 in restructuring deals.

Context logic has been placing a significant emphasis on creating value from its 2.7 billion NOLs. Their website (https://ir.contextlogicinc.com/) is very bare bones, and quarterly calls are 5 minutes with no wasted minutes (although the lack of ability to ask questions is sad as a small investor). There have been many initiatives to expedite processes and save as much money as possible. They have implemented cost-saving deals, such as delisting, to reduce listing fees, and so far seem very shareholder-centric.

Closing Remarks

Well, that was quite fun. Again, this is not investment advice, and you should do your own research. I find the special situation worth paying attention to, just as a learning experience. Thank you to all of you for bearing with me and hopefully you learning something with me along the way, even if I took you in circles for a bit,

Cheers,

18 Degree Partnership - Danel Andreev